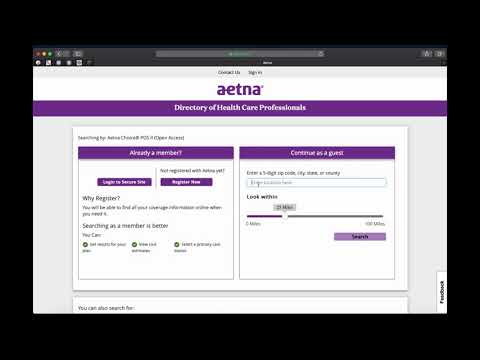

The recognized charge for out-of-network providers is the 90th percentile of the prevailing charge rate for the geographic area where the service is furnished. FAIR Health collects charge data from claims received by insurance plans and health plan administrators across the country for charges billed by physicians, hospitals and other healthcare providers. Charges reported are the full fees that healthcare professionals report to insurers as part of the claims process—not the negotiated rates that apply when visiting a network provider. Charges reported are maintained by FAIR Health in its database which is comprised of billions of claims for billed medical procedures from across the United States. New charge data are continually added to the FAIR Health database. To search for health care providers in your area, please visit and log in to your account.

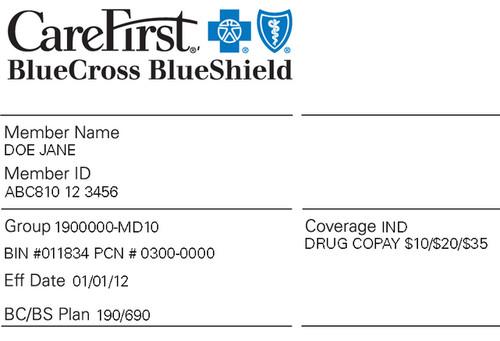

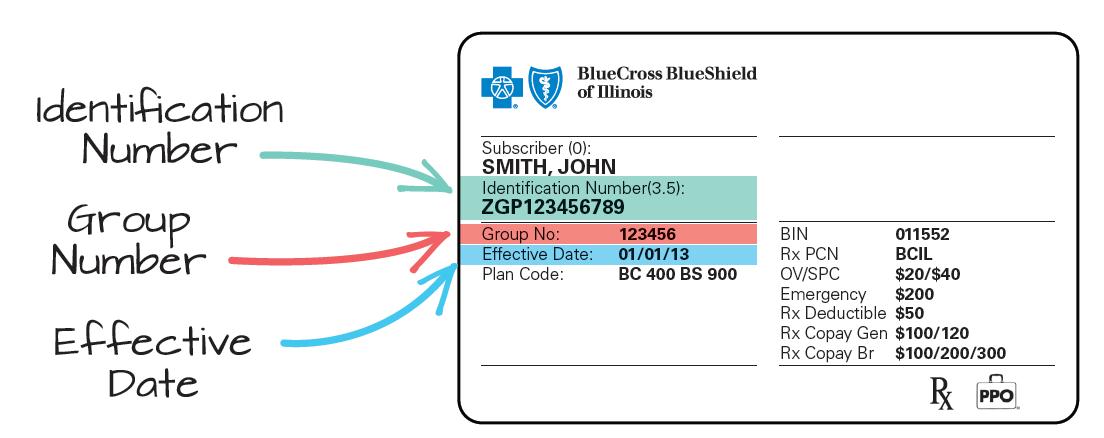

You can search for "in network providers," which are more cost effective and covered at a higher percentage by your health insurance plan. Each person covered by a health insurance plan has a unique ID number that allows healthcare providers and their staff to verify coverage and arrange payment for services. It's also the number health insurers use to look up specific members and answer questions about claims and benefits. If you're the policyholder, the last two digits in your number might be 00, while others on the policy might have numbers ending in 01, 02, etc. The cost for a visit with a Nurse Practitioner in the SHC is a $5 administrative visit fee and insurance is not billed. There are some in clinic tests, procedures, supplies, medications, and vaccines that carry an additional cost that is paid at the time the student is seen in the clinic.

The SHC does not bill insurance for these additional costs with the exception of the Aetna Student Health plan when enrolled through Seattle University. For students with insurance other than SHIP, a receipt is available if you would like to submit to your insurance company requesting reimbursement if it is a covered benefit. In general, the time that you would be using your insurance is for services such as lab work, x-rays, prescriptions and providers outside of the SHC. Insurance will also be needed for access to ER, urgent care, hospitalizations and procedures. In 2018, Emory University successfully become a self-insured (self-funded) student health insurance plan.

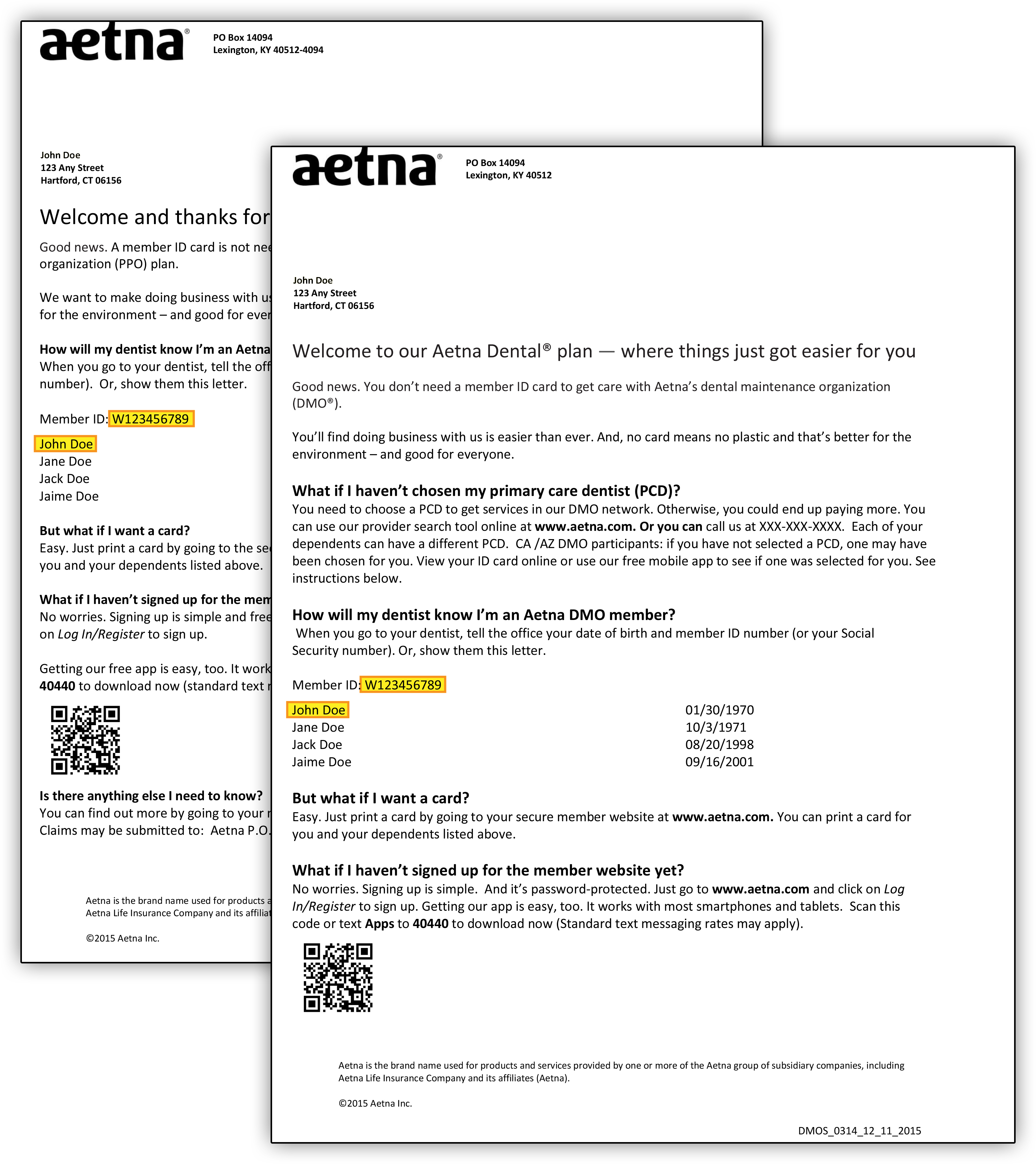

As a self-insured plan, Emory will operate its own student health plan with Aetna Student Health as the plan administrators. And with the uncertainty of available healthcare options, this is the perfect time to consider the Emory University Student Health Insurance Plan . For additional plan information, please visit the Aetna Student Health, 'your school' websiteby clicking here. Aetna Student Health administers the University of Virginia student health insurance plan.

Aetna Student Health has more than 30 years of experience in student health insurance. It employs more than 300 individuals focused on all aspects of student health insurance. Aetna Student Health partners with over 200 colleges and universities on a fully-insured basis and is the largest student health administrator in the country. It proudly points to the fact that they retain a majority of their college clients and enrolled students each academic year and that it insures more than 500,000 students and dependents nationwide.

Aetna Student Health members are provided access to preferred providers through the nationwide Aetna network. If a student experiences a qualified life event, he or she is permitted to make benefits changes within 31 days of the event. These events include changes in status such as marriage, birth, divorce, parents retired, and a spouse or partner's termination from an insurance plan. Turning 26 years of age also qualifies as a life event, as students will no longer be able to remain on their parents' health insurance plan. Qualifying events can be addressed outside of the open enrollment period throughout the year. The open enrollment period is held annually during the first two weeks of June.

Students will receive an email notification informing them about the open enrollment period. Students wanting to make changes to their current ISMMS Student Health Plan can only make changes during the open enrollment period. Opting in or out of the medical, dental, or vision ISMMS insurance plans during the open enrollment period will be effective July 1st.

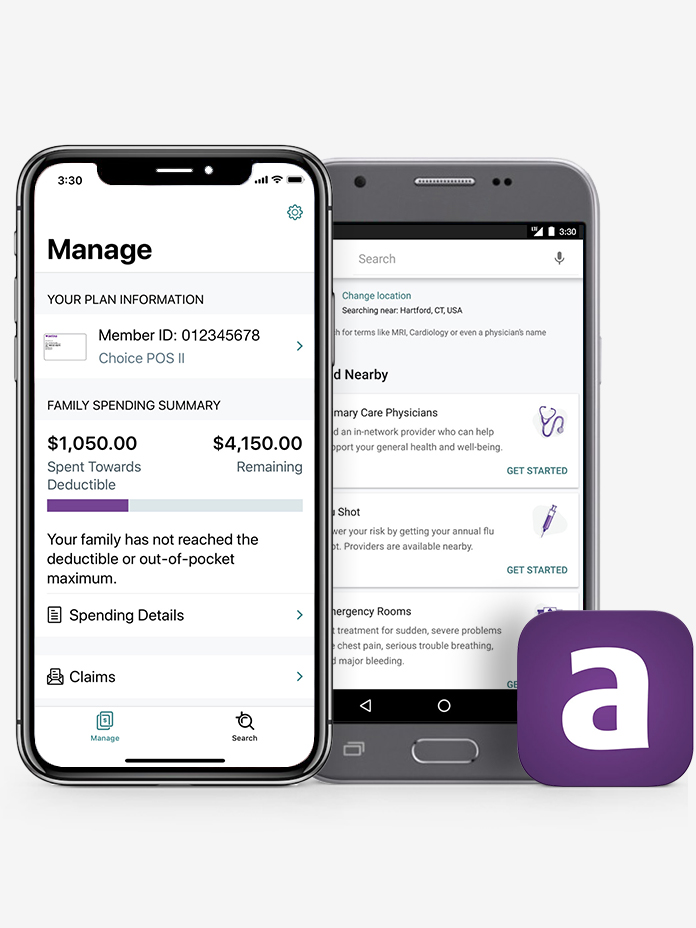

Once the annual enrollment period is over, students will not be able to change or enroll in benefits until the next annual enrollment period, unless they experience a qualified life event. Aetna automatically issues health insurance cards for the 'default' health plan option (Aetna Choice plan at the 'employee-only' coverage tier) to new fully benefits-eligible employees. To elect another health plan option and/or to cover eligible family members, you must complete New Hire Enrollment in My VU Benefits within 30 days of your hire or eligibility date (see "How to Enroll" below).

How To Find Policy Number On Insurance Card If you elect another health plan option, you may disregard the Aetna Choice card. If you choose the Aetna Choice health plan option, keep the card for your use. If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company . Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers. Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine.

Some health insurance plans do not have co-pays, but many do. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network. Many health insurance cards show the amount you will pay (your out-of-pocket costs) for common visits to your primary care physician , specialists, urgent care, and the emergency department.

If you see two numbers, the first is your cost when you see an in-network provider, and the second—usually higher—is your cost when you see an out-of-network provider. For example, when you're referred to a specific specialist or sent to a specific hospital, they may not be in your insurer's network. To improve our network and customer service, AlaskaCare selected Aetna to administer all medical and pharmacy claims and Moda Health to administer all dental claims. In the past, these services had been provided by a single company. You should have received a medical ID card from Aetna and a dental ID card from Moda to use when visiting your health care provider or pharmacy. For students wishing to enroll their eligible dependents, Aetna is requiring students to show proof of eligibility verifying the dependent's relationship to the student.

Only legal dependents are eligible to enroll in the student health insurance plan. Students are required to either enroll in the UR Student Health Insurance Plan or waive this plan if their health insurance plan meets University Insurance Criteria. All full-time students must complete the Online Health Insurance Process every year to make the insurance selection. Requests to waive the UR Student Health Insurance Plan may be audited to verify coverage.

If the student's plan does not meet the requirements, the student will be automatically enrolled in the UR Student Health Insurance Plan . International-based insurance plans often do not meet University criteria. See "Insurance with an International-based Company" below for more information. If you are enrolling in the Aetna student health insurance plan, there will be several prompts for you to follow. Once completed, you can print your ID insurance card from their website homepage.

Your health insurance policy number is typically your member ID number. This number is usually located on your health insurance card so it is easily accessible and your health care provider can use it to verify your coverage and eligibility. If applicable, a loss/end of coverage document will need to be obtained and uploaded regarding current insurance plan and submitted with request to add dependent.

You will not be allowed to disenroll from the insurance plan during the plan year unless you experience a qualifying life event (See "Changing Your Insurance Status During the Plan Year" below). Enrolling in this way (i.e., not completing the Online Health Insurance Process) is highly discouraged since it could lead to a delay in access to care during the first two months of the plan. Every year all full-time students, whether new or returning, must document their health insurance coverage by completing the Online Health Insurance Process during the appropriate open enrollment period. Students who enroll in the UR Student Health Insurance Plan are enrolled on the plan from August 1 through July 31 .

Students enrolling in UR Student Health Insurance Plan may enroll eligible dependents. Student health insurance plans are underwritten by Aetna Life Insurance Company . Aetna Student HealthSM is the brand name for products and services provided by Aetna Life Insurance Company, Aetna Health and Life Insurance Company and their affiliated companies. Coordination of Benefits is a method of ensuring that people covered by more than one medical plan will receive the benefits they are entitled to but not more than 100% of their covered expenses. The AlaskaCare health plans coordinate benefits with other group health care plans to which you or your covered dependents belong. Coordination of benefits can be very confusing, even for people who work at a physician's office.

The information provided in this summary is designed to assist you with understanding your options under Trinity Health's retirement plans. It is only an overview and is not intended to be a comprehensive description of the benefit plans available to you. It does not constitute a contract and is not meant to interpret, extend or change any plan provisions in any way.

If there is a discrepancy between printed materials, the official plan documents will prevail. Trinity Health retains the right to make changes to or terminate its benefit plans at any time, including making changes to comply with and exercise its options under applicable laws. The University of Chicago Health Plan offers comprehensive health care and benefits to the faculty and employees of the University of Chicago and UChicago Medicine and their families.

UCHP covers medically necessary care provided by UChicago Medicine physicians, specialists and other health care providers. UCHP has partnered with Aetna to administer your health plan since 2017. Aetna helps UCHP provide customer service and medical management services for its members. Although many students are adequately covered while home by their parents' plans, similar coverage in another state cannot be assumed. If you are currently covered by an insurance plan, please have a discussion with your insurance provider regarding differences in your benefits or covered services when in the Newark, Delaware, area. For all new students, it is recommended that you purchase health insurance coverage through the Valencia College myISS student portal before your scheduled On-Campus Orientation session.

Upon payment, you will be automatically enrolled in the health insurance plan, and no further action is necessary until you receive an email from Aetna. If you have family members listed as dependents on your health insurance plan, they may each have their own unique policy number as it is used for identification purposes and billing procedures. Your health insurance policy number is what identifies you as a covered individual under your current or previous plans. It's important because if you change jobs or get married, divorced, etc., then your HIPN will need to match the new situation. If you move out of state, your HIPN needs to reflect where you live now. As an Aetna Student Health Insurance member, you have access to Aetna Navigator, your secure member website, complete with personalized claims and health information.

Here you can view and print your ID card, view Explanation of Benefits, find participating providers and much more. With the Dental PPO network option, each member pays a $20 annual deductible after which cleanings, composite fillings and X-rays are covered at 100% when using participating providers. There are no benefits for additional services provided by an out-of-network provider. The University of Chicago Health Plan has contracted with Aetna to administer UCHP plan benefits. UCHP continues to provide comprehensive health care benefits through UChicago Medicine facilities including the University of Chicago Medical Center and Ingalls.

As the UCHP administrator, Aetna simply helps UCHP provide customer service and medical management services. Aetna also enables UCHP membership to better access health tools, resources and programs, such as a 24-hour Informed Nurse Healthline and online access to Plan information. UCHP does not provide coverage for out-of-area or out-of-network (non-UChicago Medicine facilities and other non-UCHP providers) expenses except under life threatening or severe emergency conditions. If you or your dependent will be out of the Chicagoland area for any significant period of time, UCHP may not provide the best health insurance coverage and you should consider one of the other benefit options. Loyola Marymount University's Excess/Injury Medical Expenses Plan provides benefits to students and student athletes as a secondary health plan.

The plan covers out-of-pocket expenses like co-pays and deductibles that are not covered by your primary health insurance when you seek care for injuries related to accidents. Students who have a personal or family health insurance plan may waive out of this plan option. You can also provide this number to your health insurance company so they can look up your information when you have questions about your benefits and any recent claims. Your health insurance company might pay for some or all the cost of prescription medicines. If so, you might see an Rx symbol on your health insurance card.

But not all cards have this symbol, even if your health insurance pays for prescriptions. Sometimes, the Rx symbol has dollar or percent amounts next to it, showing what you or your insurance company will pay for prescriptions. If you have health insurance through work, your insurance card probably has a group plan number. The insurance company uses this number to identify your employer's health insurance policy.

Your insurance company may provide out-of-area coverage through a different health care provider network. If so, the name of that network will likely be on your insurance card. This is the network you'll want to seek out if you need access to healthcare while you're away on vacation, or out of town on a business trip. Centura Health accepts and bills most major insurance companies as a source of payment. However, some of their benefit plans do not cover treatment at some Centura Health locations. It is recommended that you contact your insurance company directly if you have any questions about coverage at a Centura Health location.

The AlaskaCare plans limit payment of covered services to the recognized charge. The recognized charge is the maximum amount the AlaskaCare plans will pay for a covered service. Aetna and Moda/Delta Dental, and their respective network providers , agree to a set of discounted negotiated rates for services provided. The recognized charge for network providers is the negotiated rate. For an explanation of how the recognized charge is calculated for out-of-network providers, please see the recognized charge questions under the Network and Dental sections. DISCOUNT OFFERS ARE NOT INSURANCE. They are not benefits under your insurance plan.

You get access to discounts off the regular charge on products and services offered by third party vendors and providers. Aetna makes no payment to the third parties--you are responsible for the full cost. Check any insurance plan benefits you have before using these discount offers, as those benefits may give you lower costs than these discounts. Part-time faculty and staff members can become eligible for medical coverage under the Affordable Care Act regulations.

There is a small group of part-time employee grandfathered under a former policy, for which additional details regarding this plan can be found within the health care premium comparison below. The same dependent eligibility outlined for full-time faculty and staff also applies for part-time faculty and staff. Every fall, all students must waive out or enroll in the Aetna student health insurance plan.

When you go to an appointment with your health care provider, they will ask you for your insurance information. If you lose your health insurance card with your policy and group number on it, it is important to contact your health insurance company right away and let them know. Call your insurance provider's customer service number and a representative should be able to help you. Since the Nurse Practitioners don't bill your insurance for their time then it's generally not a problem that they're not in network. You will only need to pay the $5 visit fee for the NP visit. Your insurance would be needed for services such as lab work, x-rays, or referrals to specialists.

Insurance is also needed for access to ER, urgent care, hospitalizations and procedures. Occasionally an insurance restricts out of network providers from referring to a specialist or order more expensive test; check with your insurance to see if this is an issue for your policy. You might see another list with 2 different percent amounts. When you get a health insurance policy, that policy has a number. On your card, it is often marked "Policy ID" or "Policy #." The insurance company uses this number to keep track of your medical bills.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.